Skift Take

The winds of change are blowing in corporate travel and expense. By automating and integrating travel, payment, and expense management data and processes, companies can turn traditionally complex and reactive workflows into more simplified, proactive solutions.

This sponsored content was created in collaboration with a Skift partner.

Digitization of the customer experience is influencing every corner of corporate travel. When it comes to payments and expense management, that means offering more seamless solutions for employees so that they don’t have to figure out how to pay for business travel, manually collect and input receipts, or spend hours filing expense reports.

It’s not just about the user experience; these solutions offer organizational efficiencies as well. Companies that aren’t ready to make the shift to virtual cards and automated expense management are now out of sync — with financial technology advancements, with travel supplier payment systems, with internal departments, and ultimately with what their employees want.

This article explores key behavioral changes among business travelers and how companies can adjust their corporate travel, payment, and expense policies and processes in ways that increase efficiency, reduce costs, and improve employee satisfaction.

Resolving Pain Points in Payments and Reconciliation

Business travelers globally are increasingly demanding that their employers offer technology they use in daily life. For example, contactless payments became much more widespread during the Covid-19 pandemic, and contactless transaction values are expected to double in the next five years. Corporate card users who’ve adopted this technology in their personal lives now expect the same simplicity and ease of use when they travel for work.

The shifting tech landscape has led corporate travel and finance managers to an inflection point as well. Coordinating business travel is complex, and the payment and expense management process itself is costly and painful to manage.

“Expense management is a reactive process,” said Ajay Singh, vice president, digital payment and expense product development at BCD Travel. “Plus, there are all these different traveler profiles — VIPs, road warriors, infrequent travelers, even non-employees — who all have different requirements, and that causes a lot of pain for travel managers.”

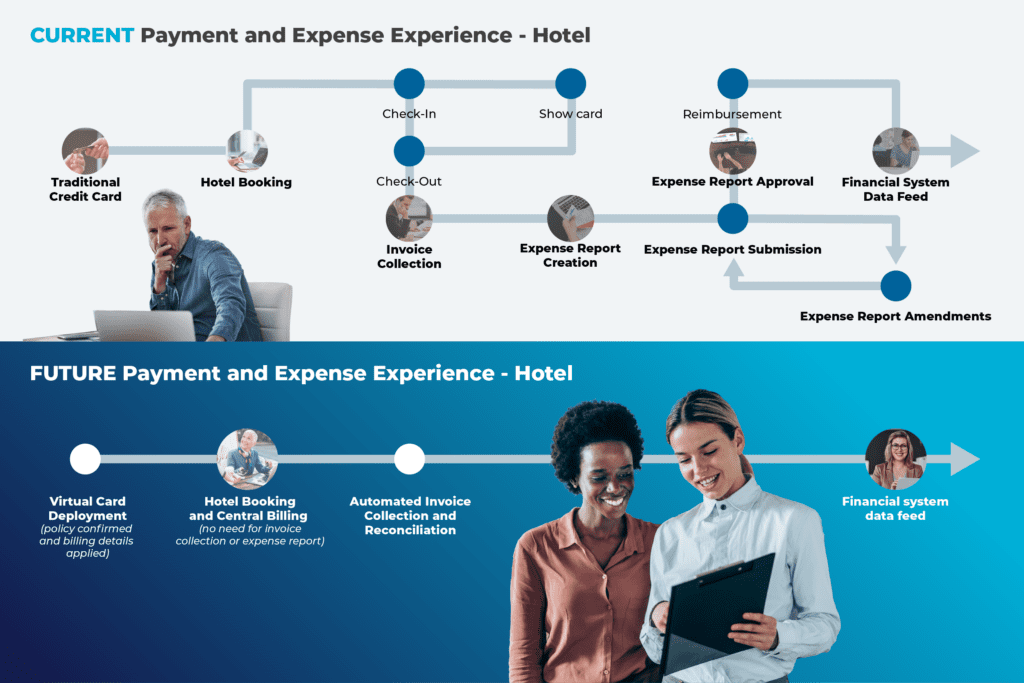

Historically, the root of the challenge for expense management has been the lack of integration among different systems and processes. (See the image below for a snapshot of what a typical payment and expense experience for a hotel booking looks like today.) Virtual cards are one example of how digital solutions integrate payments, policy, and expense management to make the process more proactive. By bringing these elements together, they present a huge opportunity to transform corporate travel, payment, and expense, Singh said.

One key advantage of virtual cards — which can be deployed during a trip booking or before a start of the trip as a unique card or payment token via a user’s mobile phone — is that they’re flexible. They can be either one-time or multiple-use, and they can have a fixed limit. In the future, virtual cards will be able to be provisioned into mobile payment systems such as Apple Pay, Samsung, and Google Pay for a particular trip or particular spend.

Another important advantage is that managers can embed rules around how those virtual cards can be used — and update them instantly in response to specific scenarios instead of having to review and reissue an entire corporate travel policy.

Furthermore, instead of issuing a plastic card that lasts three or five or seven years and can be swiped whenever and wherever, a virtual card is much more controlled. Since virtual cards have various built-in policy, controls, and spend limits, they are more secure compared to a traditional card.

Because spending data can all be tracked in real time, there’s no need for a traveler to file an expense report. As travelers use their mobile phones to pay contactless for coffee, meals, taxi rides, or hotels, they can get the charges in real time and upload the receipts, if required, on the go. By the time they are done with their trip, all the expenses, if compliant, are ready to be pushed into finance and expense systems. Companies can also input the cost center and billing details ahead of time so that costs don’t have to be allocated after the fact.

By automating and integrating payments, policy, and expense reporting, “you’ve turned the whole process upside down,” said Singh. “You’ve taken a reactive process with a lot of manual steps and made it more proactive, more real time, more dynamic, and more automated compared to what it is currently today.”

The Promise of a New Payment and Expense Process

Transformation is never easy. First of all, while there are plenty of early adopters out there, it will take some time for a majority of today’s business travelers to change their technology habits, even if they’re excited by the potential benefits.

There are also practical considerations for companies on the technical side. As one example, some automated expense solutions work by consolidating all travel costs into a single payment method with a single payment issuer. That works well in some instances, but it’s not realistic for programs with multiple suppliers and multiple payment partners.

Meanwhile, hundreds of billions of investment dollars have gone into financial technology, or fintech, in the past several years. That includes merchants that have adopted contactless payment systems, as well as major banks and card issuers (i.e. Visa, MasterCard, AMEX) upgrading their existing platforms to support new types of payment structures on the backend. In addition, more and more companies are exploring solutions and services where travelers do not have to use personal cards for business trips.

With these trends converging, there’s an urgency for companies to keep up, addressing automation needs so that their own systems can use the tools and data they’re getting from suppliers. Ultimately, companies have to take a hard look at what suits their technological capabilities and their traveling employees best, and then work together with their travel management company and technology partners to develop the right combination of solutions to begin their payment and expense journey.

“The digitization of corporate travel is going to go through a phased transformation that will shape out over the next few years, requiring training and early adopters to come on board,” said Singh. “But there’s a tremendous value proposition that these new solutions are bringing to the industry — merchants, their clients, service providers like us, and the traveler.”

The downside during this transformation period is contending with the status quo, which is characterized by fragmented processes and systems. There are silos within organizations themselves, silos between travel suppliers and distribution systems, and silos between financial institutions, which all go decades back. As one transaction moves through from end to end, every system is different and has different information and data.

The antidote to this fragmentation is data integration. By seamlessly and proactively connecting travel to payments to automated expense reporting and reconciliation, companies will be able to gather more consistent, more accurate data, which can allow them to consolidate this information into a single view of their program.

Singh noted that data integration usually has been a painful, manual process sitting with different teams. By using artificial intelligence/machine learning capabilities to bring a lot of data sets together, companies are able to match, reconcile, and simplify those processes.

“The solution is tying everything together at the time of booking and at the time of the trip,” said Singh. “So instead of a backward-looking expense management process, you improve or remove expense management as we know it today. It’s still happening, but all in the background. The payment becomes your expense management, and the policy is embedded together. It’s reactive to proactive, manual to automated, complex to simple.”

For more information about BCD Travel’s payment and expense solution, visit https://www.bcdtravel.com/travel-management/bcd-pay/.

This content was created collaboratively by BCD Travel and Skift’s branded content studio, SkiftX.

Have a confidential tip for Skift? Get in touch

Tags: bcd travel, business travel, corporate travel, SkiftX Showcase: Technology, travel technology