Skift Take

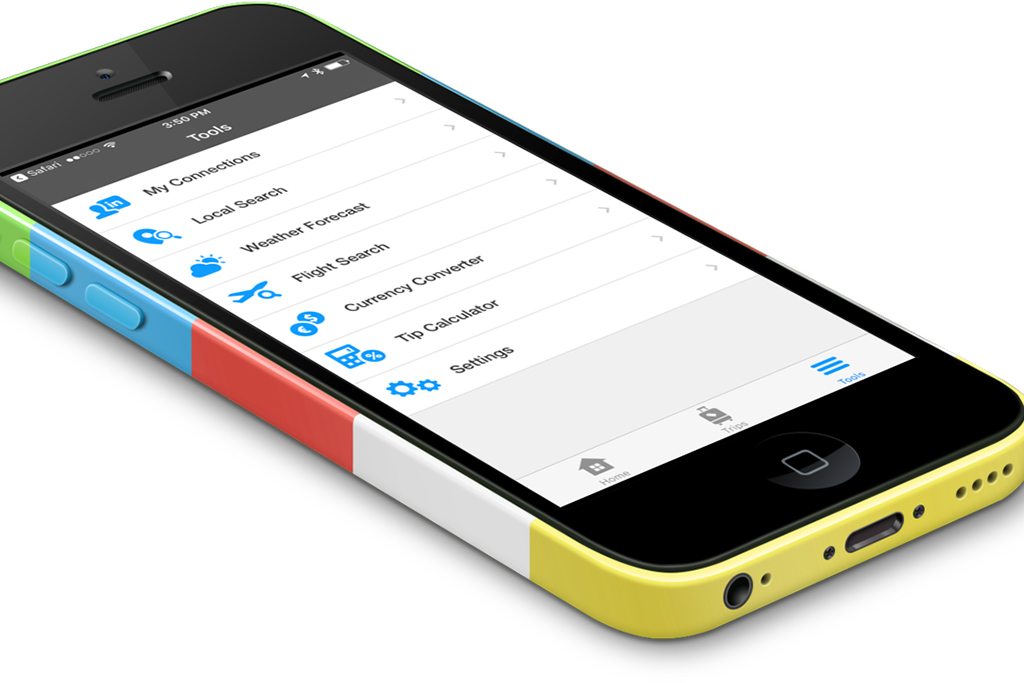

WorldMate suffered as many smartphones and other services added free travel notifications. But TripCase and TripIt still have fans among many frequent travelers.

Back in the days of Blackberrys, Nokia S60s, and Palm Pilots, WorldMate was the leading mobile app for organizing itineraries. During the 2000s, it was routinely one of the top 10 highest-grossing mobile apps.

Yet WorldMate is winding down after a 17-year-run, surprising many. (It claimed 10 million users.) At the end of March, travel management company Carlson Wagonlit Travel will pull the app from stores. By September it will stop supporting many of the app’s functions. Gone. Poof.

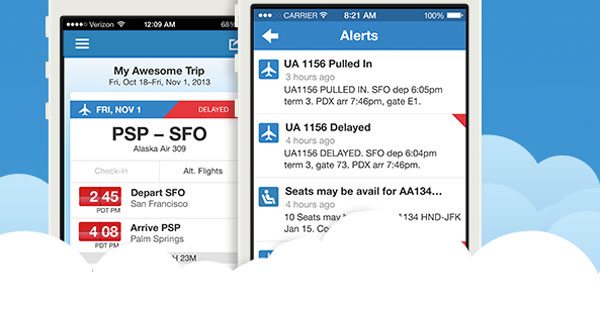

Rivals now see an opening to gain share. The largest is TripIt, which touts having 13 million user accounts. It’s run by travel expenses software company Concur, part of German software group SAP.

The other top competitor is TripCase, which claims 11 million user accounts. It is backed by travel software company Sabre.

There’s a debate over user numbers. App Annie, which tracks downloads, says that in the U.S., TripIt has seen well over 5.7 million downloads since late 2009 and TripCase has seen more than 2.8 million downloads since its launch, across both iOS and Google Play platforms.

TripIt measures a user as someone who signs up for and verifies an account. Some users go web-only, and some access TripIt via the mobile web, neither of which situations would be traced by App Annie. TripCase measures users similarly.

Lost Mojo

WorldMate was most popular in Europe. After 2007, TripIt eclipsed it as the hot commodity in the Americas.

In recent years, WorldMate, TripIt, and TripCase have all been undermined by the spread of free tools like Apple Wallet for displaying flight and hotel information on the fly.

For instance, a user of Gmail and a Google Android phone can see details of their upcoming flight and hotel reservations extracted and displayed on their phone screens automatically at the relevant moments.

That said, TripCase says it added more than a million users in December, and TripIt said its engagement levels have remained “strong”.

Why WorldMate Wiped Out

A spokesperson for Carlson Wagonlit, which acquired WorldMate in 2012, describes the consumer-focused WorldMate app as “a non-strategic and de minimis part of our business.” It decided that putting the effort into supporting a consumer-facing app with product and engineering resources didn’t align with its core as a travel management company.

Some industry insiders expected the move. Nadav Gur, one of WorldMate’s co-founders and its chief executive for a decade, says, “The company lost its consumer-marketing and consumer-product experts years ago, mostly before the acquisition by Carlson Wagonlit.”

Innovation had stalled. “So, if anything,” adds Gur, “I’m surprised they waited four years to shut down the consumer brand.”

Tricky Business

The business of trip organizing has coalesced around a few models.

One is centered on selling advertising that is more relevant to the user thanks to knowing where and when the consumer is traveling.

But ads aren’t moneyspinners anymore. WorldMate tried advertising, along with a subscription offer for avoiding the advertising, to modest effect.

Last year TripIt abandoned ads on its free apps, presumably due to a lack of success. TripCase says advertising isn’t a significant part of its approach. Both rely on subscriptions.

Another model — one that WorldMate pursued heavily — is upselling travelers on hotel and car rental bookings and earning commissions along the way. The theory is that a traveler is more likely to book, say, an Uber ride if the ride is promoted to their phone when their flight lands than at another time.

Another option is building a database of traveler profiles, and then selling the anonymized data to suppliers. Yet another model is offering the itinerary software as a white-label service to suppliers. TripCase is flirting with both of these ideas.

One thing that won’t work is lead-generation for travel management companies. WorldMate’s app was not helping persuade corporations to sign up for Carlson Wagonlit’s services. In other words, the decision-makers Carlson Wagonlit most wants to influence are travel managers, but travel managers typically don’t travel much themselves, and thus weren’t using WorldMate or being impressed by it.

In short, the sector keeps experimenting with business models. It seems like Calvinball, where the players discover the rules as they go along.

The X-Factor: Google

The rise of Google’s trip management tools intimidated WorldMate, one former Carlson Wagonlit employee says. The Google Trips app that debuted last year is also aimed at anyone who is looking for things to do, see, or eat — plus information about how to get around — when they’re in one of some 200 destinations. That mobile experience makes sense for leisure travelers, but it could also matter to people traveling for business, some experts say. (Google declined to comment for this article.)

TripCase and TripIt officials say they don’t fear competitors. What sets their services apart from rivals like Google is that travelers can use them regardless of email provider. (Users can forward booking confirmation emails from any account, and the companies have integrations for automatically trawling for reservations in multiple types of email services. Google, in contrast, is basically limited to Gmail.)

Still, the rise of Google points to a broader issue about competition in the consumer marketplace. One former WorldMate executive adds that Carlson Wagonlit risked entering “a race to volume rather than profitability. I don’t think it’s possible anymore to do another TripIt or WorldMate as a consumer play.”

Said differently: A challenge TripCase and TripIt each face is that consumers benchmark travel services against online travel agencies and search sites, such as Expedia and Booking.com, and against mobile-first tools from richly funded startups, like Airbnb and Uber, who often invest very heavily in user-facing tech to improve experiences, increase conversions, and increase loyalty.

If a tech company like Carlson Wagonlit, Sabre, or Concur is not investing large sums of money in consumer-grade interfaces, they risk travelers rejecting their mobile user interfaces as being comparatively clunky or outdated.

A former WorldMate executive, speaking anonymously so as not to step on the former employer’s message, says: “The reality is that to compete for lightly managed and unmanaged frequent travelers, one needs large amounts of capital for product development and marketing and customer acquisition. That threshold is getting higher every year.”

What’s more, neither parent company Sabre or Concur SAP has much experience with consumer marketing, putting them at a disadvantage with traditional consumer players.

Sabre’s Bold Bet

Keeping up with consumer-grade standards is a key reason why Sabre backs TripCase, says Florian Tinnus, vice-president of Sabre Traveler Experience division, within the Sabre Travel Network line of business.

Most of TripCase users are consumers, not corporate users, the company says. That makes the product unique for Sabre, which mostly provides business-to-business services. The parent company sees TripCase as a research-and-development test bed for its corporate mobile tools, the company’s bread-and-butter.

Tinnus says the company’s investment in TripCase is “strong and stable”, despite the WorldMate collapse. Looking ahead, TripCase strives to build its own email-parsing engine — the tool that extracts data out of emails forwarded or searched — to replace the template-based one it licenses from WorldMate, which may be discontinued. Sabre aims to use more machine learning and intelligent messaging to get more feedback when the parsing process goes awry, i.e., when an email is misread.

Sabre is also creating direct-connect feeds from some hotel groups, to pull in reservation data without consumers having to lift a finger. Reservations made through the company’s network, used by 425,000 travel agents and its SynXis central reservation system, relied on by 30,000 hotels, can automatically flow into a user’s TripCase messaging channel.

In a test with 300 properties since September, hotels have been able to directly send personalized promotions and upgrade offers to guests using TripCase. In turn, the hotels promote the app to consumers.

Tinnus places the test in a larger context: “What we have learned through several studies is that travelers feel they have to use too many apps. We also find that travelers alternate between sometimes traveling for business and sometimes traveling for pleasure but perhaps wanting a unified tool to handle both types of trips…. So our mission is to create a single place for all your trips.”

If Sabre’s strategy works and it stays the course, riches await, predicts one former WorldMate executive. Some itinerary-management companies will try to sell subscriptions, while others will try to profit off the traveler data. Whoever can achieve a critical mass in terms of itineraries and form an ecosystem matching travelers with traveler suppliers might win big.

“The key would be forming partnerships that could reduce acquisition costs while avoiding biases that would prevent the participation of the travel supplier partners,” one former executive says.

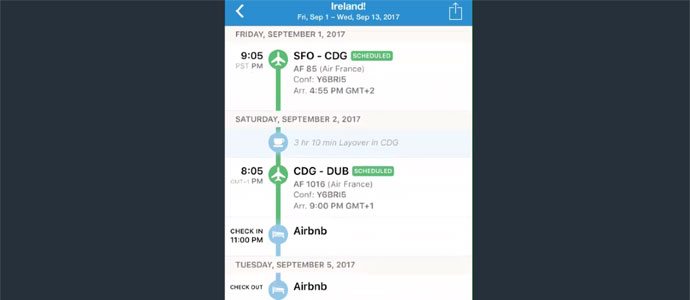

TripIt updated its timeline layout on the trip summary screen in August of 2016. CORRECTION: 4pm ET The author misidentified this screenshot at publication. Sorry.

TripIt Says It’s in It to Win It

Concur doesn’t agree with the notion that trip-management apps are outgunned against other consumer companies.

Jen Moyse, director of product, says, the proof of the company’s commitment is that, in the past year, it has been doubling down on its user-experience. It updated all of its platforms at the same time.

For example, in the past week, TripIt launched a Navigator screen that more concisely presents information in real-time from more varied sources. A new integration with data from Rome2Rio lists ground transportation options (along with their costs and estimated journey times), ranging from public transit to private services like Uber

Moyse adds, “Our users also want to access their itineraries and other information in new ways.” In 2016 the company did more to take advantage of iOS’s enhanced messaging.

“In the past year, we improved the functionality for wearable devices, like Android Wear and Apple Watch, and we improved the quality of our notifications across channels,” she adds.

The subscription service, TripIt Pro (at $49 a year), includes several perks.

CORRECTION 4p.m. ET: I originally said TripIt Pro includes “alerts if you have been booked in a middle seat on a flight”. But I should have written, “a feature that helps users find a better seat if they don’t like the seat they have.” Sorry.

Possible Spoilers: A New Wave of Startups

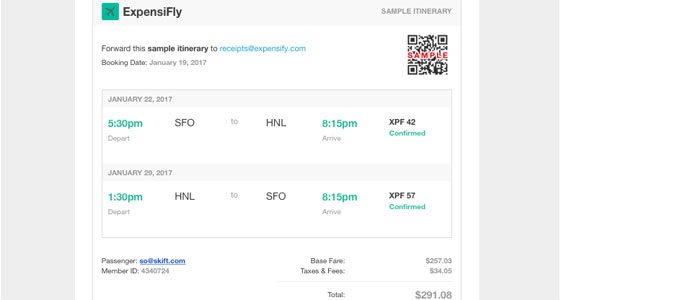

There’s a small wave of startups aiming to scoop up users who are defecting from WorldMate. Two of the most notable are Expensify and Pana.

Expensify is a micro-managing business app for expenses that is used by 100,000 companies. As perks, it provides live flight status updates and it creates automatic expense reports from itineraries.

This is limited functionality. Individual consumers booking non-business trips are probably better served by another itinerary management app that focuses exclusively on that.

But founder David Barrett says, “If you are a business traveler looking to do more than merely ‘not miss your flight’, then Expensify becomes a stronger choice because we seamlessly combine your itinerary data with the receipt and expense data you are already capturing.

“So if you are traveling with the intent of actually doing business when you arrive, then Expensify’s automatic reporting can group together all the receipts you scan while on the trip, and submit them as one report to your company for reimbursement. Similarly, our integrations with systems like Uber automatically capture your receipts (just use Uber’s “business profile” feature) so you needn’t think of them.”

Expensify isn’t alone in offering services like this, but it shows how major players like TripCase and TripIt face some fracturing of the market.

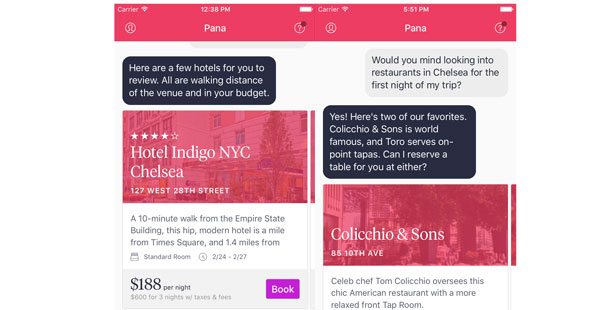

Pana is a straight-up competitor to TripIt and TripCase that was founded last year. Unlike those legacy giants, it focuses on leisure travelers specifically.

Founder Devon Tivona says “the features that make up an amazing leisure trip planner are very different than what makes an expert personal assistant for frequent travelers.”

Tivona believes that WorldMate’s collapse “signifies how vastly and fundamentally different the worlds of managed and unmanaged travel are, and that trying to jump that gap (from either direction) is a difficult move to make.”

Both TripIt and TripCase disagree with that view. Each one says there’s a set of frequent travelers outside of heavily managed corporate programs who are willing to pay for the convenience of having their travel information and records stored in a consistent, easily retrievable place. Each also believes that travelers switch between leisure and business personas at will and, as noted above, only want a single app to use.

Pana counters that it is stealing away a slice of the market with superior interfaces because of its leisure focus. For example, one of its rare sharing features is making it automatic to alert someone that a traveler’s flight is delayed and to collaboratively build shared itineraries in a unified trip plan.

WorldMate Is Dead. Long Live WorldMate

As for the WorldMate wind-down, the brand and company live on as a research and development center in Tel Aviv for Carlson Wagonlit Travel, which says, “We are materially increasing our product and engineering resources and capital spending on our mobile and digital platforms, making strategic investments to enhance our capabilities.”

Amir Kirshenboim, vice president and chief technology officer of the digital product division, is putting the team to work on the suite of tools aimed at driving top-line revenue growth for its core business with corporate travel clients. That suite goes beyond CWT to Go, its flagship itinerary-management product. WorldMate plans to expand that team, says a former insider, speaking anonymously.

Perhaps its most lasting legacy is two-fold. It pioneered concepts like finding relevant reservations in your emails, sending flight change alerts, and displaying boarding passes that update in real-time with gate changes. These were widely cloned.

But WorldMate also replaced the technologically suspicious mindset of Carlson Wagonlit — which some said had the kind of bureaucracy you might expect in an oil-rich, one-party state — with the quick iterative approach favored by engineers from Mountain View to Tel Aviv.

That changed mindset may be the legacy that most helps Carlson Wagonlit as it faces competition with Expedia-backed, tech-heavy Egencia on a global stage.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: itinerary management, trip planning, tripit, worldmate

Photo credit: As of March 31, WorldMate's itinerary-management apps will be removed from mobile app stores by parent company Carlson Wagonlit Travel.