Skift Take

Ahead of going public, Amex GBT has provided a compelling argument for growth in its 53-page document, with a string of acquisitions and partnerships already under its belt. But does its enormous size now line it up for success, or weigh it down?

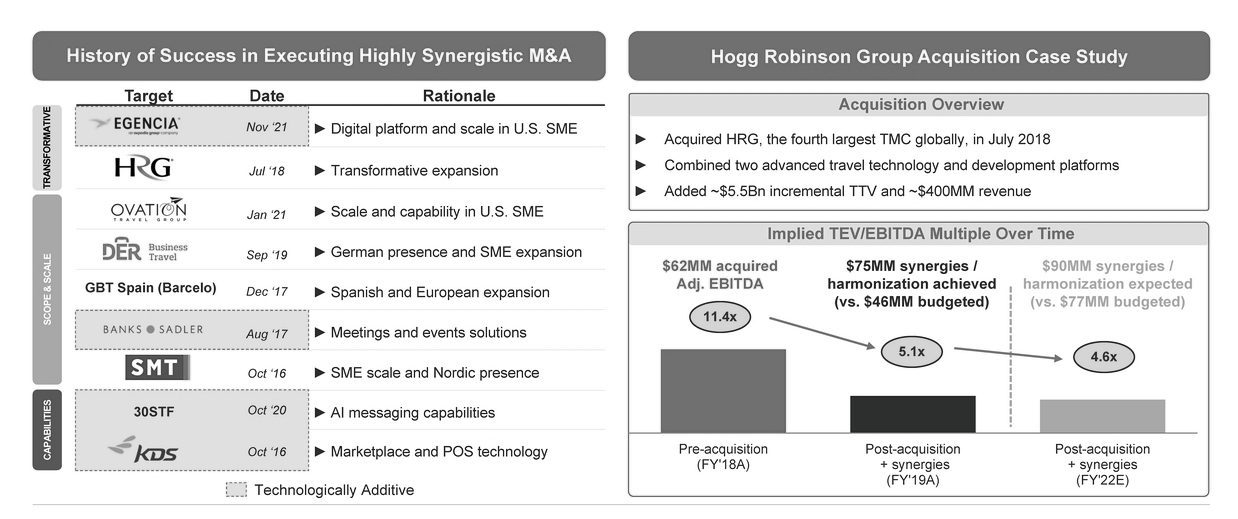

This isn’t American Express Global Business Travel’s first rodeo. The world’s biggest corporate travel agency has been busy dealmaking and snapping up rivals since it bought HRG back in 2018 (price tag: $543 million).

For its next ride, Amex GBT is merging with a blank-check company, or so-called SPAC, backed by asset manager Apollo to become a publicly traded company.

It will list on the New York Stock Exchange in the first half of next year under a new name, Global Business Travel Group (GBTG), but gets to continue doing business under its current brand due to an 11-year trademark agreement which takes effect upon the deal’s closure.

Here’s a rundown of some of the highlights from the agency’s 53-page investor prospectus, which was filed with the U.S. Securities and Exchange Commission last week, including screenshots of portions of the document.

- Amex GBT significantly grew in size during the pandemic. It bought Ovation Travel in January this year, and later Egencia, the business travel division of Expedia, completing the deal in November. Last year it bought technology company 30SecondsToFly. It’s quite the backstory.

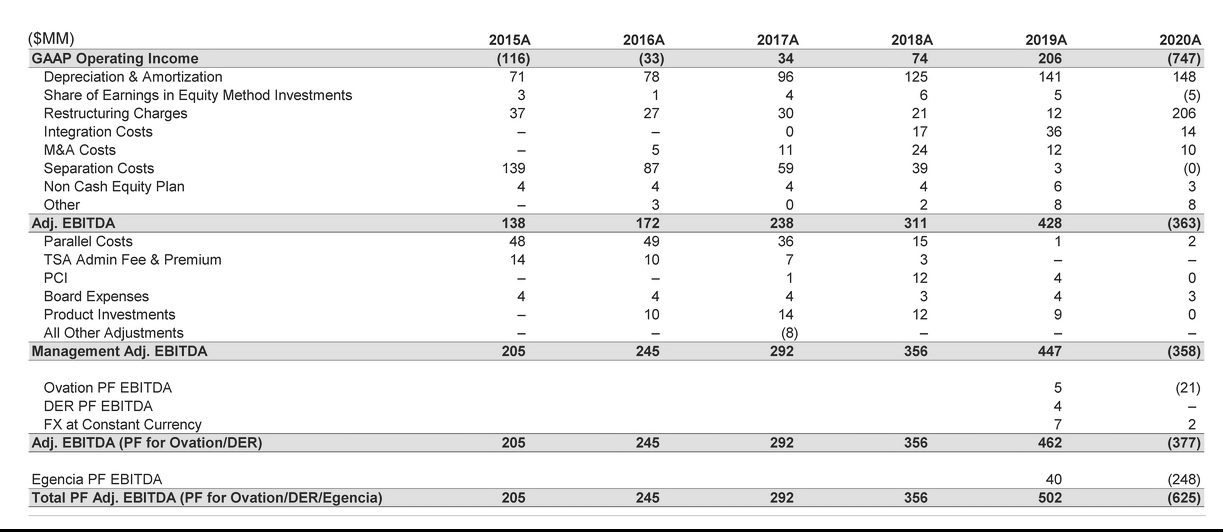

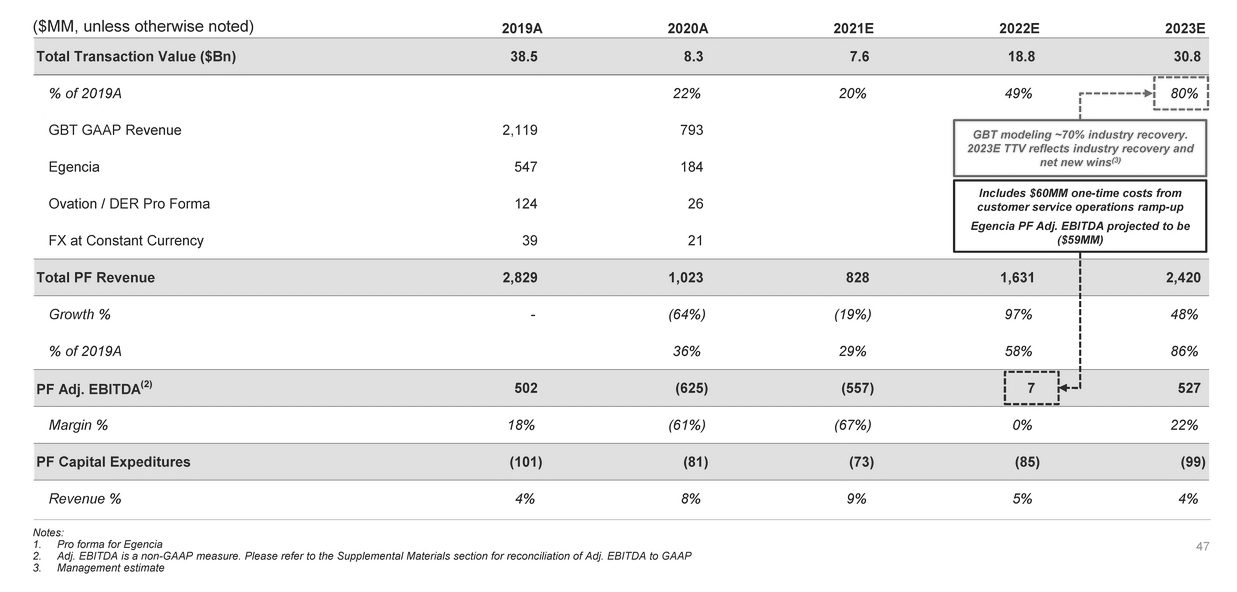

- The prospectus reveals just how hard the pandemic hit the corporate travel sector, with a snapshot of losses incurred across several agencies. In 2020 Amex GBT posted an adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) loss of $363 million, compared to a profit of $428 million in 2019. Pro forma EBITDA for the agencies it acquired include Egencia’s loss of $248 million and Ovation Travel’s loss of $21 million in 2020.

- There were hefty restructuring costs for Amex GBT, comprising $206 million of charges in 2020, compared to just $12 million in 2019. The agency said $235 million worth of cost savings were executed in 2020, which represents 13 percent of its cost base in 2019. Downsizing doesn’t come cheap.

- Amex GBT is feeling pretty upbeat. It predicts its total transaction volume will return to 80 percent of pre-pandemic levels in a couple of years in fact. In 2019, it recorded $38.5 billion in transactions, which dropped to $8.3 billion in 2020. However, by 2023 it predicts transactions will bounce back to $30.8 billion. But interestingly, the agency pegs overall recovery for the sector at 70 percent, which begs the question where the extra 10 percentage points come into play.

- Setting out its road to recovery, the prospectus reveals Amex GBT’s growth strategy is to target the small and medium-sized enterprise market. Both its recent acquisitions were designed to scale up growth in this area, which it described as “the fast-growing industry segment with the largest addressable market.” The acquisitions mean it is “well positioned to capture the shift from unmanaged to managed SME travel.”

- While some travel agencies prefer to invest in their own technology, like CWT and its MyCWT platform for example, Amex GBT is widening the net. Its Apollo deal includes new investors Sabre and Zoom coming onboard. Amex GBT will make a multi-million dollar, long-term annual investment in joint technology development with Sabre over the next 10 years. Zoom meanwhile said it looks forward to “working with their talented team as they strive to deliver innovative and engaging virtual, face-to-face, and hybrid meeting and event experiences” in the announcement statement.

- Amex GBT wants to position itself in the heart of a vast travel ecosystem, between customers, suppliers and intermediaries like the global distribution systems. The agency is also forging ahead developing a connected marketplace of suppliers. As part of its Egencia deal, parent company Expedia took a 13 percent stake in Amex GBT, so there will be a lot of crossover with the online travel agency’s content as part of a 10-year accommodation supply agreement with Expedia Partner Solutions. Amex GBT is also 50 percent owned by an investor group led by Certares, which itself is building up its own empire. It was recently involved in a $6 billion reorganization plan for Hertz, alongside Apollo and Knighthead, and in September this year invested $354 million in Avia Solutions Group. This blank-check maneuver could be Certares’ checkmate move, not least because a previous deal fell through due to the pandemic. But would-be investors might want more detail around where the revenue will come from. With so many assets and partnerships, synergies will no doubt boost the bottom line. But how much each of these will contribute organic growth for the company remains to be seen.

- CORRECTION: A previous version of the story incorrectly reported that Egencia had a pro forma loss of $625 million.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: amex gbt, certares, coronavirus, corporate travel, cwt, egencia, expedia, hertz, investors, sabre, travel management, travel technology, Zoom

Photo credit: Amex GBT has made a string of acquisitions over the past few years. Vladimir Kudinov / Unsplash