Skift Take

AWS and Skift’s 2021 Digital Transformation Report is a critical roadmap for the travel, aviation, and hospitality industries as they embrace emerging digital realities and opportunities. This article takes a closer look at travel companies in Europe and their responses to key trends and strategies for digital transformation.

This sponsored content was created in collaboration with a Skift partner.

Covid-19 created an urgent need for travel companies to develop solutions in response to new digital demands. Various markets illustrate diverging business priorities, consumer cultural differences, and technology investment strategies. To help better understand some of these differences, this article examines key highlights from Amazon Web Services (AWS) and Skift’s recent 2021 Digital Transformation Report, with a more detailed focus on trends in Europe in comparison to other geographic regions.

Even prior to the pandemic, a clear mandate was already emerging: Adopting digital transformation, a strategic imperative that promotes digital-first business practices, toolsets, analytics, and ways of working, will be essential for companies as they weather changes caused by the pandemic and ensure their long-term success.

Progress on digital transformation initiatives is not evenly distributed across the world, or even among industry players themselves. For example, 92 percent of leaders in the aviation industry said it was much more important to proceed with their digital transformation plans in light of Covid-19. That’s 6 percentage points higher than among executives in other industries.

“The big difference we’ve seen [compared] to other years is people booking closer in,” said John Hurley, chief technology officer for Ryanair. “Traditionally we would see people booking typically 20 weeks ahead. They would plan their holidays and they go ahead. At the moment, people are waiting to be sure they’re safe.”

This year’s survey responses indicate that European travel organizations currently lag in adoption of certain digital transformation practices. Executives in the region acknowledge that their recovery plans are proceeding in fits and starts thanks to evolving levels of confidence among travelers in any given country. However, when it comes to general optimism in their outlook and plans for investment in the future, Europe is among the world’s leaders.

Slow Recovery Results in Short-Term Hesitancy

It’s a moment of transition for Europe’s travel and hospitality sector. After more than a year of regional travel lockdowns that slowed growth, those in the industry are looking to use the remainder of 2021 and 2022 to reset, reassess, and set the sector up for success in the years ahead.

European executives’ uncertainty surfaces when applied to digital business practices. European travel and hospitality leaders rated their digital competitiveness less highly than their peers in other regions of the world, with 67 percent noting that their businesses “keep pace with the competition” (compared to 60 percent who said the same worldwide). Meanwhile, only 21 percent said they were “ahead of the curve” (compared to 29 percent globally).

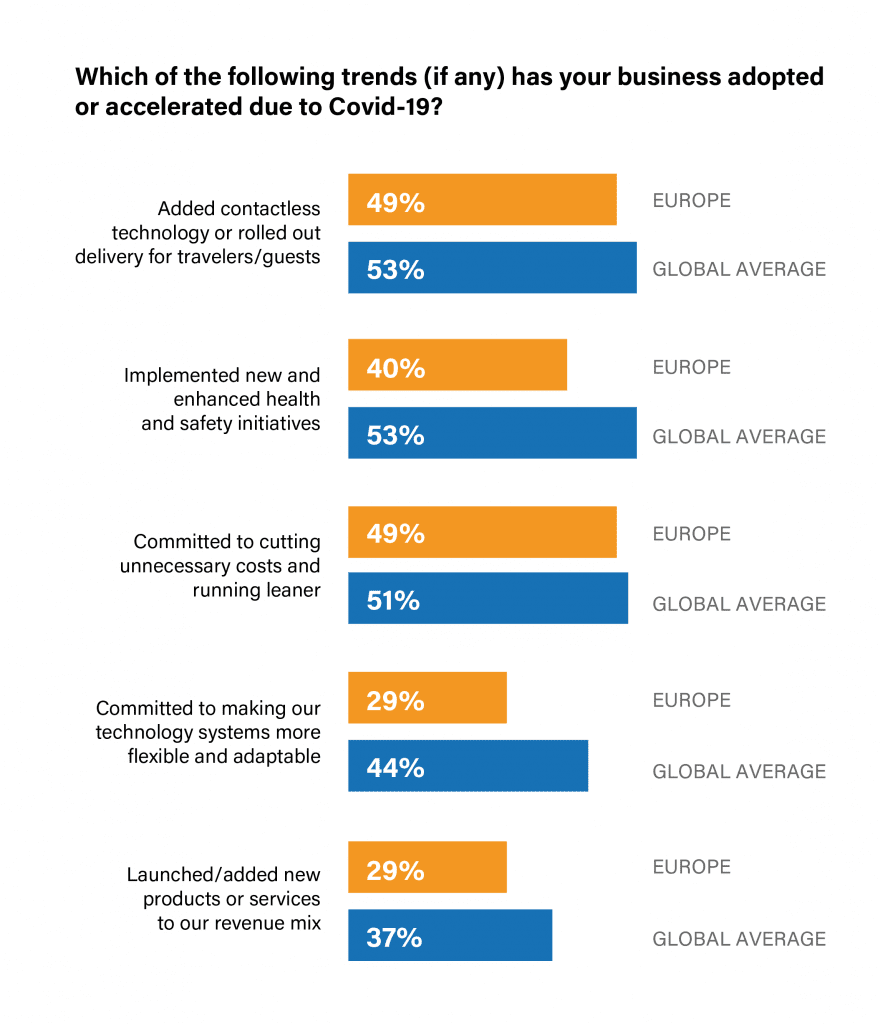

Europeans were also not as likely to adopt or accelerate key business trends seen across the world during the pandemic. The biggest gap was in committing to make technology systems more adaptable and flexible. Just 29 percent of European travel executives said that Covid-19 pushed them forward on this front, in comparison to 44 percent of executives worldwide.

Furthermore, more than one in five European travel executives said that they do not intend to move their operations to the cloud at this time, compared to just 15 percent globally. Overall, nearly 60 percent of European executives said that their companies were either non-committal or in the “early stages” of cloud migration, compared to about 50 percent of respondents who gave the same responses globally.

Talent Shortages Provide One Cause for Pause

One of the main reasons for hesitancy may lie in the fact that Europeans were far more concerned about talent shortages than their counterparts in other regions of the world. Many executives reported some difficulty recruiting and retaining skilled employees who are fluent in the capabilities of digital-first organizations, and executives in Europe made it clear that this was a chief concern hindering their technology strategies.

When asked about the biggest barrier in switching to cloud-based IT and software solutions, 24 percent of European travel executives said lack of experienced staff, in comparison to a global average of 17 percent. Among both sets of company leaders, this concern was cited as the second-most common response, behind a lack of budget.

“Since Covid started, it’s been a challenge, but the one thing we’ve observed is that location doesn’t matter,” said Ryanair’s Hurley. “You can work from home. Suddenly you’re competing with anybody in Europe.”

Similarly, when asked about challenges to their ability to use business data more effectively, 50 percent of travel executives in Europe cited a lack of skilled employees, in contrast to just 38 among global respondents. While about one-third of all respondents felt that a lack of staff was an impediment to their data capabilities, it was the third-most commonly cited concern among Europeans, whereas it was only the sixth-largest concern on average across the world.

This same question hinted at an optimistic outlook for the technology itself, however. European executives believe that neither data and security nor IT and infrastructure challenges are as big of a roadblock to cloud adoption as their global colleagues. Just under one-third of European respondents saw this as an issue, in comparison to about 40 percent on average globally. In Asia Pacific, for example, nearly half of executives (48 percent) saw data security and privacy issues as the biggest impediment to their success.

An Optimistic Outlook on the Cloud’s Potential for Efficiency and Innovation

Even though European executives may not be as outspoken on existing digital competitiveness when compared to other regions, they report confidence in their systems and are optimistic for the promise of the future. Survey results suggest that there is significant interest in upgrading their capabilities using cloud computing to support goals like business innovation.

For example, Ryanair’s Hurley explained that the cloud has been a revolution for his company, taking advantage of an otherwise uncertain time while the aviation industry was shut down. Operations and engineers had considerable downtime when all the aircraft were grounded, which provided opportunities to brainstorm ideas and get budgets going. A number of projects focused on non-customer-facing parts of the business bubbled up, and the use of cloud technology enabled the company to iterate quickly on issues like machine learning for predictive maintenance.

“Like every IT person in the world in the past, you had an idea, you’d go through procurement, you’d get hardware, you’d get six-month lead time, you’d go through all these steps and processes,” said Hurley. “Whereas now, you have an idea, you can give it a go and you can learn very quickly.”

Across Europe, this sentiment persists. A significantly higher percentage of European leaders said they were interested in using digital tools such as automation to save money and improve efficiency. Fifty-one percent of European leaders mentioned using automation as a priority in 2021 and 2022, compared to just 29 percent who said the same globally.

European travel and hospitality leaders were also more enthusiastic about the potential benefits of cloud computing to support growing efforts to facilitate business innovation and make it easier to scale capacity. Fifty-five percent of European leaders said that cloud-based IT and software would help “accelerate our pace of innovation” (compared to 39 percent globally). Twenty-seven percent of European leaders also said cloud could make it easier to scale their business (compared to 20 percent globally).

“The AWS platform [gives us] the ability to innovate in a way that we haven’t in the past,” confirmed George Turner, chief commercial and technology officer for IHG Hotels & Resorts, in an interview about its use of the cloud to power new guest experiences. “It [also] helps us test and learn in really fluid environments, and then roll these [services] out.”

With many European countries easing out of lockdowns, it may take some time for travel companies in the region to gain full confidence in the recovery’s trajectory. Therefore, those that have pushed forward through the pandemic and continue to move forward with their innovative approaches to digital transformation will have an advantage in 2022 and beyond.

To learn more about how digital transformation is impacting travel brands worldwide, make sure to download the full Skift and AWS report.

This content was created collaboratively by AWS and Skift’s branded content studio SkiftX.

Have a confidential tip for Skift? Get in touch

Tags: amazon web services, AWS, cloud technology, digital transformation, travel technology